Enough is Enough, Stop the GOP Tax Plan

UPDATE: The Senate has passed the bill. Now the Senate and House are working to pass a bill that both chambers agree on. They aren't far apart, but it's not over yet. Call your Congressperson: "I'm a Kentuckian, and I urge you to join me in opposing the tax plan." (And thank Rep. Yarmuth.)

Need a little inspiration? Check out western Kentuckians speak truth to Rep. Comer at a quickly organized Town Hall in Hopkinsville on Monday, Dec. 4. Thanks to all these members and folks!

KFTC is working for a day when companies and the wealthy pay their share of taxes and can’t buy elections. The Republican tax proposals coming out of Washington – from the person occupying the White House, from the House, and most recently from Senator McConnell's Senate – are deeply problematic.

The intent of these plans is not to fix a problem in our tax code, or even to reduce the national deficit. The intent of these plans is to cut taxes for the wealthy and corporations, and to make vulnerable the programs that so many of us depend on: especially Medicaid, Medicare and Social Security. The plans violate our values that tell us to be with each other in hard times and they undermine the role of our government. They are a scheme to dismantle our core democratic institutions, and we must fight them.

Here in Kentucky, Governor Bevin and Republican Party leadership have tried to follow the same blueprint. For lots of reasons, including your work, their momentum has been challenged. Together, we can have an impact on the federal landscape as well.

Learn More

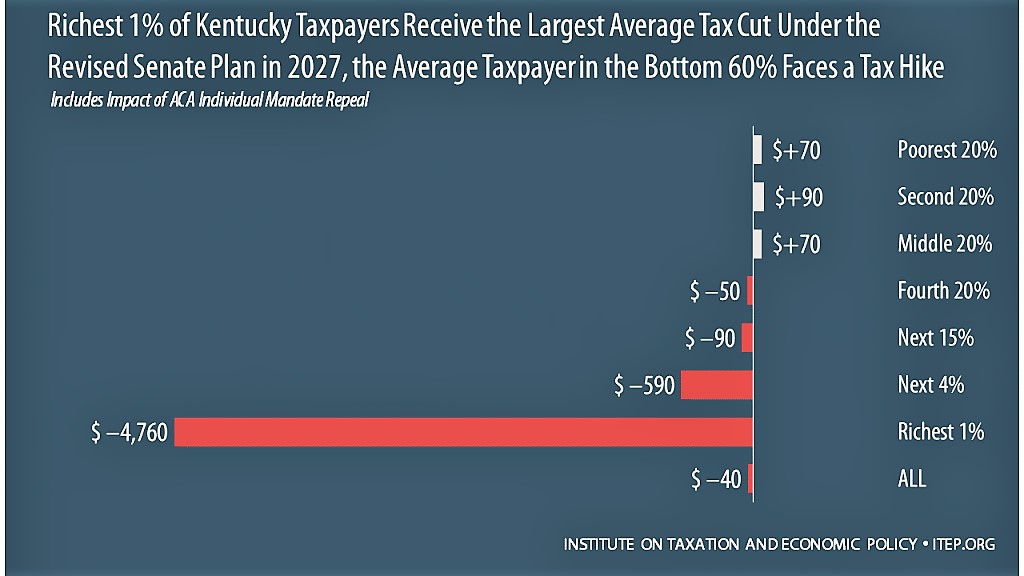

When the House bill would hit full effect here in Kentucky, the households with the lowest incomes would see an average of a $90 tax cut. Kentucky’s wealthiest 1% would see an average tax cut of $41,410. (Institute for Taxation and Economic Policy)

Those hearty tax cuts for the wealthy and for corporations come at a big cost – estimated to add $1.5 trillion to the national debt over 10 years. That’s $150 billion a year. Here’s what the people of the United States could do with $150 billion a year:

-

Double Pell Grant aid, and

-

Double cancer research at NIH, and

-

Fund the full backlog of maintenance at national parks, and

-

Treat 300,000 people with addiction, and

-

Help the families of six million kids afford child care, and

-

Train 3.5 million workers for in-demand jobs.

The Senate Bill is different in one big way, as of November 14: It includes a repeal of the individual mandate in the Afforadable Care Act.

Take Action

Make the Calls

Call Kentucky's Senators and your U.S. House member and tell them that you oppose the Republican plan to cut taxes for corporations and millionaires.

(If your Congressperson is Rep. John Yarmuth, thank him for his opposition to the GOP tax plan.)

U.S. Senators

Sen. Rand Paul

202-224-4343 – Washington

270-782-8303 - Bowling Green, the only Kentucky office

Tweet to @RandPaul

Paul's Online Contact Form

Sen. Mitch McConnell

(202) 224-2541 – Washington

Tweet to @SenateMajLdr

McConnell's Online Contact Form

U.S. House Members

Rep. James Comer, 1st District

202-225-3115

@KYComer

Rep. Comer online contact form

Rep. Brett Guthrie, 2nd District

202-225-3501

@RepGuthrie

Rep. Guthrie online contact form

Rep. John Yarmuth, 3rd District

202-225-5401

@RepJohnYarmuth

Rep. Yarmuth online contact form

Rep. Thomas Massie, 4th District

202-225-3465

@RepThomasMassie

Rep. Massie online contact form

Rep. Hal Rogers, 5th District

202-225-4601

@RepHalRogers

Rep. Rogers online contact form

Rep. Andy Barr, 6th District

202-225-4706

@RepAndyBarr

Rep. Barr online contact form

Additional resources

-

Americans For Tax Fairness's Thanksgiving Digital Toolkit.

-

A story from WFPL about where members of Kentucky’s Congressional Delegation stand on the House bill.

-

The Kentucky Center on Economic Policy is closely monitoring the House bill and its impacts. You can find their most recent reports on their blog.

-

The Center for Budget and Policy Priorities has an extensive collection of quick hits about what they call the GOP Two-Step Agenda, or how the tax cuts for corporations and the wealthy undermine programs that we all all depend on – as workers, women, children, the elderly, students and so much more.

-

Congressional Timeline for Tax Bill from Americans for Tax Fairness

-

Institute on Taxation and Economic Policy has analyzed the House bill’s impact across income groups, nationally and here in Kentucky.

-

An article on the Senate plan from Vox, but note that this was before the plan included repealing the individual mandate--a key element of the Affordable Care Act, and what makes it possible to cover people with pre-existing conditions.

- Home

- |

- Sitemap

- |

- Get Involved

- |

- Privacy Policy

- |

- Press

- |

- About

- |

- Bill Tracker

- |

- Contact

- |

- Links

- |

- RSS