Kentucky's tax structure is inadequate

For KFTC's 30th Anniversary, several members created squares for a quilt representing our shared vision for Kentucky.

Folks made squares showing good jobs, a healthy earth, healthy food, and healthy friends and family. Good public education and clean air. A homeplace that's vibrant with life. We know what we want. We also know that to get there, Kentucky has to raise revenue.

"I’m one of many in my community and in this state who has spent a lot of time looking for a job, and a lot of time trying to go back to school. This time last year, I was one of 16,000 low-income students who qualified for, but was denied, financial aid for school because the state ran out of money."

Linda Stettenbenz

Jefferson County

"Miners and former miners like myself who have sons, daughters, nephews and friends working underground are so aware of the importance safety plays in monitoring the activities companies demand of miners. The budget cut for mine safety is unconscionable."

Carl Shoupe

Harlan County

This isn't a new problem

Kentucky's emerging revenue crisis was exposed in 2001, with the publication of the legislature-commissioned Fox Report, which found that Kentucky has a structural deficit. This means that since 2001, we've known that Kentucky's current tax system doesn't generate enough revenue to meet our needs. In 2005, KFTC and allies published Raising the Bar: Kentucky's Real Budget Report, which showed that to match the average investment of our surrounding states, Kentucky would have to raise $1.8 billion. So while the recession has exacerbated Kentucky's budget problems, it didn't cause them. Kentucky's revenue shortfall is caused by a fundamental problem – called a structural imbalance – that predates the recession.

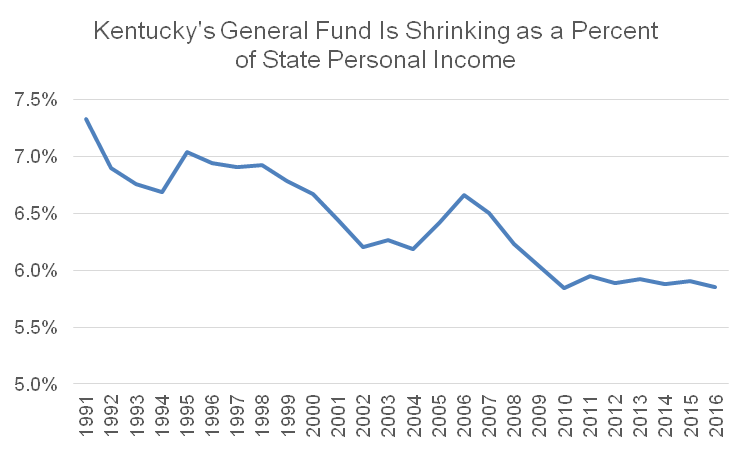

The graph to the right is from the Kentucky Center for Economic Policy, and shows Kentucky's General Fund revenue as a share of the economy.

The graph to the right is from the Kentucky Center for Economic Policy, and shows Kentucky's General Fund revenue as a share of the economy.

A solid revenue stream would at least keep pace with the economy. This graph shows that, as bad as the economy has been, our revenues still haven’t kept up with it. The resulting trend is that the gap between what we have and what we need to maintain a basic levels of services is getting wider every year.

We have good, common sense solutions that will raise revenue fairly

The solutions in our Kentucky Forward Plan would raise between $350 and $450 million a year, according to the Legislative Research Commission. And the plan would raise this revenue while also making our taxes fairer to Kentucky's lower- and moderate-income working families.

The solutions in our Kentucky Forward Plan would raise between $350 and $450 million a year, according to the Legislative Research Commission. And the plan would raise this revenue while also making our taxes fairer to Kentucky's lower- and moderate-income working families.

We need political will. This means we need you!

Visit our action page to get involved!

- Home

- |

- Sitemap

- |

- Get Involved

- |

- Privacy Policy

- |

- Press

- |

- About

- |

- Bill Tracker

- |

- Contact

- |

- Links

- |

- RSS