As income inequality grows, take action to strengthen the federal estate tax

United for a Fair Economy, a national organization and ally of KFTC, has issued a call to action around the federal estate tax.

The strength of the federal estate tax is important to Kentucky. Kentucky used to get a portion of the revenue generated by the estate tax. This revenue disappeared in 2005, as the estate tax was phased out under President Bush.

A strong federal estate tax would mean more money for Meals On Wheels, after-school programs, and public safety. UFE's action alert:

Estate Tax Update: The Fight's Not Over Yet

The estate tax is the most progressive tax in the US, paid by less than 0.5% of all estates. The right wing has been yearning for years to get rid of the tax and, while permanent repeal is off the table, opponents are still trying to gut the tax in the reform process.

Congress passed the final budget in May that would keep the estate tax at the 2009 exemption of $3.5 million per spouse, with a 45% rate on amounts above the exemption. In April, the US Senate voted for a budget amendment to further reduce the estate tax. The amendment would have permitted a $5 million estate tax exemption per spouse ($10 million per couple) and a lower 35% rate. Fortunately, Congress did not include this measure in the final budget – thanks to the efforts of UFE's members and those of allied organizations.

But, there's still the issue of a one-year repeal of the estate tax in 2010 to be addressed, another morsel left behind by the Bush Administration. The Senate wants to pass permanent estate tax changes this year, but may not get to it because they are working on healthcare reform; given the slugfest that the debate has turned into, we're not too surprised.

The House is considering passing a "one-year patch" when it returns in September to prevent the 2010 hiatus. Under a tight timeframe with a packed Congressional agenda, this would be a solid step toward passing a permanent estate tax law in 2010 as part of an overall tax reform.

Your voice is an important part of determining what the tax reform will look like. Check out UFE's Quick Facts, Quick Action page to see what you can do.

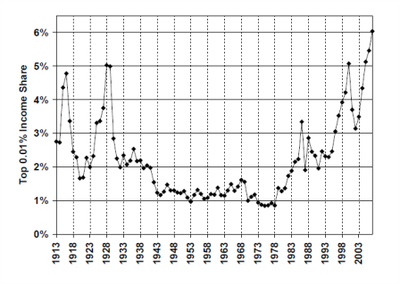

The debate is becoming eve more urgent as new information comes to light about income inequality. A recent study shows that in 2007, America's most affluent – the top .01% – grabbed the biggest share of income since at least 1913, when the IRS started recording such things. The graph below, with the New York Times, tells the story.

Recent News

Kentucky’s past legislative session showed alarming trend toward government secrecy

Churchill Downs takes more than it gives. That's why the Kentucky Derby is a no-go for me

‘We must never forget.’ Kentucky town installs markers for lynching victims.

Featured Posts

Protecting the Earth

TJC Rolling Out The Vote Tour – a KFTC Reflection Essay

KFTC Voter Empowerment Contractor Reflection Essay

Archives

- Home

- |

- Sitemap

- |

- Get Involved

- |

- Privacy Policy

- |

- Press

- |

- About

- |

- Bill Tracker

- |

- Contact

- |

- Links

- |

- RSS

Add new comment