February 4, 2013 at 05:58pm

The Kentucky General Assembly reconvenes next week with lots of important issues to tackle – and plenty of opportunities for KFTC members to make a strong grassroots presence felt in the decisions that will be made.

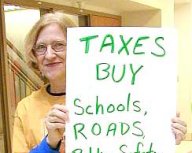

The opportunities start on Tuesday, February 5 when Rep. Jim Wayne has invited us to join his press conference to introduce a comprehensive tax reform bill. Rep. Wayne has been the strongest voice in the General Assembly for progressive tax reform that meets our principles of fairness, adequacy and improving the quality of life for Kentuckians. We plan to show our support at an 11 a.m. press conference in Capitol Annex Room 129. Please join us if you can.

January 31, 2013

Lexington Herald-Leader

AT&T is circulating a proposed bill for the 2013 General Assembly that would deregulate basic local telephone services in the service areas of AT&T, Windstream and Cincinnati Bell in Kentucky. That means many Kentucians would no longer be guaranteed access to basic local service as a stand-alone option.

January 21, 2013 at 01:13am

Reposted from yesterday's Herald-Leader - an op-ed by Herbert Reid and Richard Knittel - who are (amongstother things) KFTC members from Lexington and Versailles, respectively.

One valuable scholarly study of the right to vote states "despite its pioneering role in promoting democratic values, the United States was one of the last countries in the developed world to attain universal suffrage."

The same study reminds us that it was the civil rights movement led by Martin Luther King Jr. that brought "the abolition of almost all remaining restrictions on the right to vote."

On Monday, American citizens will see another anniversary of the unfortunate 2010 Supreme Court decision (Citizens United v. Federal Election Commission) bringing an unprecedented flood of money into our electoral process.

This year, the anniversary coincides with the national day honoring the civil rights movement's greatest leader.

December 20, 2012

The Courier-Journal

Louisville shelters “have had to turn away homeless families and homeless individuals, because there are no beds available for them.” More funding, not more budget cuts, are needed, a report from the U.S. Conference of Mayors concludes.

December 8, 2012 at 10:14am

Kentucky would get significant new revenue – but corporations would get a major reduction in taxes – under a package of tax change proposals approved Thursday by the Blue Ribbon Commission on Tax Reform.

December 7, 2012

The Courier-Journal

The Kentucky Blue Ribbon Commission on Tax Reform has finalized a set of recommendations about how to improve Kentucky's tax structure and raise needed revenue. The full package could raise nearly $700 million in new dollars in the first year. It also includes several items, including an Earned Income Tax Credit, that KFTC members have long supported.

November 26, 2012

Lexington Herald Leader

KFTC member JoAnn Schwartz has been participating in and following the conversations of the Kentucky Blue Ribbon Commission on Tax Reform. In this piece she reflects on the reasons Kentuckians can feel both hopeful and concerned as the Commission develops its final recommendations. And she urges us all to stay engaged.

December 1, 2012

New York Times

Kentucky spends at least $1.41 billion per year on incentive programs, according to the most recent data available. That's about 15% of the state's annual budget. According to their data, the oil, gas and coal industries are the top recipients of state and local tax breaks.

November 28, 2012

The Nation

This article gives a shout out to KFTC as one of many groups working to build a new economy that creates good jobs, curbs inequality and addresses urgent threats to our environment and democracy.

November 21, 2012 at 03:39pm

The Blue Ribbon Commission on Tax Reform met Monday and worked through a lot more options for reforming the state’s tax code. The group is nearing completion of its work, but still has some important decisions to make.

As in recent meetings, the commissioners adopted some recommendations that would move Kentucky’s tax system closer to the principles of adequacy and elasticity (grows as the economy grows), but at the same time did that in ways that would make the system overall more regressive and thus less fair to lower and middle incomes.