Kentucky's Tax Structure Is Not Fair

Our tax structure

holds Kentucky back

"My family is at our library at least once a week to keep current on our reading and to introduce our 3-year old and our 8-month old to the world of books. It seemed like my local library always had a shelf full of new books on display. Now I only see a handful.”

"My family is at our library at least once a week to keep current on our reading and to introduce our 3-year old and our 8-month old to the world of books. It seemed like my local library always had a shelf full of new books on display. Now I only see a handful.”

Carter Wright

Jefferson County

"I decided to return to school for nursing, but when I looked into the program at Western, I was shocked. When I started there in 1999, going full-time cost me $1,100 dollars. Now, a mere 13 years later, it costs over $4,000 dollars. That's a semester! What's happened here is the drastic defunding of my alma mater, and all of our universities and colleges, and a shift of the cost of education from the General Fund to the student. And the real world result is students leaving school with crippling debt."

Alan Smith

Warren County

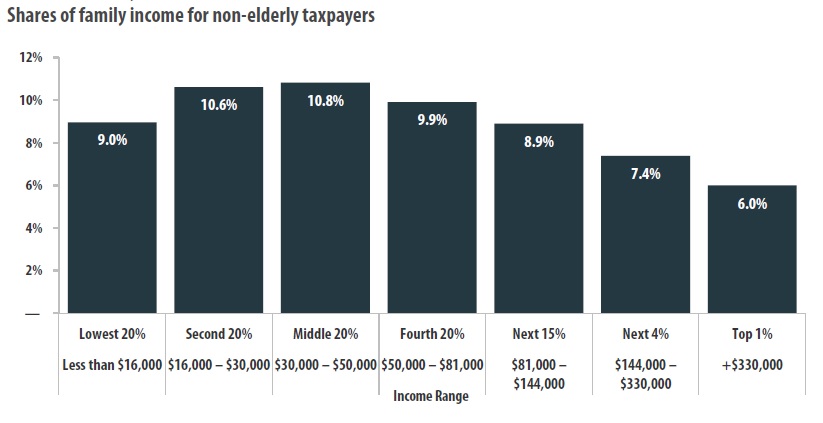

How much Kentuckians pay in state and local taxes as a percentage of their income

Kentucky’s tax structure is skewed, asking the most from those who earn the least, and asking the least from those who earn the most.

Check out this graph from the Institute on Taxation and Economic Policy to see how our state and local taxes impact Kentucky families:

Low- and middle-income Kentuckians pay about 9-10% of their income to state and local taxes, while the state’s wealthiest 1% pay about 6% of their income to state and local taxes. This is called a regressive system.

Reforms like the Earned Income Tax Credit and a more progressive income tax can make our tax structure fairer.

See also: Kentucky's tax structure is inadequate

- Home

- |

- Sitemap

- |

- Get Involved

- |

- Privacy Policy

- |

- Press

- |

- About

- |

- Bill Tracker

- |

- Contact

- |

- Links

- |

- RSS