Tax Commission proposal: more from individuals, less from corporations

Kentucky would get significant new revenue – but corporations would get a major reduction in taxes – under a package of tax change proposals approved Thursday by the Blue Ribbon Commission on Tax Reform.

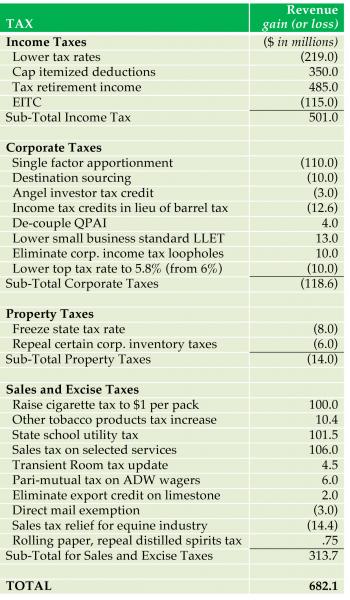

The tentative projections show that General Fund revenue could increase by $682 million through increases in income and consumption taxes. Meanwhile, corporate taxes would be reduced by more than $120 million – more than 25% of current corporate income tax revenues. Road Fund revenues also would be reduced slightly.

The recommendations will be sent to Gov. Steve Beshear later this month. He is expected to ask legislative leaders to back the package of reforms in a likely special legislative session some time in 2013.

At Thursday’s meeting, big questions about restructuring the individual income tax were settled, with decisions making the income tax more progressive (meaning it asks more from those with greater incomes). The commission agreed to recommend an Earned Income Tax Credit – an anti-poverty program that KFTC and allies have pushed for years and helped put on the commission’s list of options – at 15% of the federal credit. They also put a cap on itemized deductions and removed the exemption on retirement income (except for Social Security) once total income exceeds $30,000 a year.

Jason Bailey of the Kentucky Center for Economic Policy, Sheila Schuster of the Advocacy Action Network and Rep. Jim Wayne (a non-voting member of the commission) led the effort to defeat a regressive flat tax favored by some commissioners. Projections showed that a flat would mean an average tax decrease of nearly $5,000 for those with income greater than $200,000, and a tax increase for low and middle-income folks.

Kentucky’s tax system overall is already regressive in that it asks lower and middle income folks to contribute a higher percentage of their income to state and local taxes

“I think that we heard more at all of the public hearings about fairness than any other single topic,” Schuster said. “Our system is outdated and unfair to lower income Kentuckians.”

As he had been reminding the commission at almost all of its meetings, Bailey said the income tax “is the cornerstone of the revenue system. From a revenue and tax fairness perspective, the income tax … is the only tax based on the ability to pay.”

In response to a comment from a commissioner about not wanting to “penalize higher incomes,” former state senator Joe Wright said: “I don’t view it as a penalty if someone make s a lot of money and has to pay more income tax. When I was paying more taxes I was doing a lot better. It never bothered me to pay taxes. Why not help this state and help our fellow man?”

Rep. Wayne also disagreed with the labeling of the progressive proposals as a penalty. “There’s a social responsibility that those of us who have made it have for the common good.”

The vote was in favor of graduated tax rates over a flat tax.

A similar discussion followed concerning itemized deductions, which generally are more beneficial as incomes increase. A proposal to eliminate itemized deductions completely was challenged by several commissioners, including organized labor representative Rocky Comito, who advocated for keeping some deduction for charitable donations and mortgage interest. The final decision was to place a dollar cap on itemized deductions at a level that would bring in about $552 million in new revenue. However, that figure was later changed to $350 million by a non-voting commission staff member, and was the figure included in the final tabulations.

This package of changes will increase income tax revenues by $500 million, with incomes lower than $30,000 paying less and those above paying more.

However, it is hard to say whether the tax system overall will be more or less regressive because of the $313 million in new revenue that will come from increases in the sales, cigarette and utility taxes – which by nature are all regressive.

The huge giveaway in corporate taxes – representing more than 25% of the current amount of corporate tax revenue – was challenged by Rep. Wayne and Bailey. But this didn’t seem to bother some commissioners. It’s why they were there.

In fact, coming into Thursday’s meeting, the revenue estimates for decisions made at previous meetings showed a $92 million tax reduction for corporations. So the commissioners on Thursday voted another $26 million in corporate tax reductions.

“Do we need to give this much in corporate tax breaks?” Rep. Wayne asked. “That’s $100 million for corporations that our consultants show we’re already competitive and really don’t need. There has been no study that shows this is going to increase our competitiveness.”

Overall, the proposals could raise about $682 million a year in new revenue as seen in the table below. That’s significant given the reluctance of legislators in the past to raise any new revenue. However, it’s far short of the $1 billion revenue shortfall the state is projected to have over the next decade, and does not equal the current level of under-funding of existing programs. And a report that came out a few days ago from another task force said there is a need to add $300 million a year to state pension funds in order to put that program on solid footing.

Recent News

Kentucky’s past legislative session showed alarming trend toward government secrecy

Churchill Downs takes more than it gives. That's why the Kentucky Derby is a no-go for me

‘We must never forget.’ Kentucky town installs markers for lynching victims.

Featured Posts

Protecting the Earth

TJC Rolling Out The Vote Tour – a KFTC Reflection Essay

KFTC Voter Empowerment Contractor Reflection Essay

Archives

- Home

- |

- Sitemap

- |

- Get Involved

- |

- Privacy Policy

- |

- Press

- |

- About

- |

- Bill Tracker

- |

- Contact

- |

- Links

- |

- RSS

Comments

Recommended Corporate Tax Breaks

How can the Blue Ribbon Tax Comm. even suggest a 25% tax break for corporarations? Don't they see the unraveling social safety net and increasing numbers of Ky children in poverty? Many more are homeless too.

Add new comment